Security Tokens, Tokenized Assets, Synthetic Assets, and much more

What you will learn

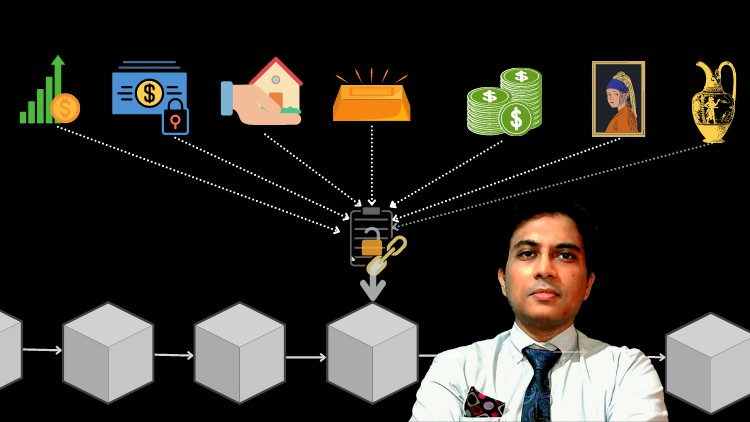

Fundamentals of Tokenization

Types of Tokenization: Security Tokens and Tokenized Assets

Financial and Capital Market concepts related to Tokenization

Blockchain concepts related to Tokenization

Security Tokens: What are Security Tokens? How do they work? Types?

Comparison of Security Token Offering with IPOs and ICOs

Tokenized Assets: What are Tokenized Assets? How do they work? Types?

Regulation of Security Tokens and Tokenized Assets

Examples of platforms facilitating Tokenization

Securitization and Tokenization

Impact of Tokenization on Capital Markets

Choices and Challenges in Tokenization

Future prospects of Tokenization

Description

Trillions of dollars in crypto assets may seem a lot but still, most of the world’s securities and assets are off-chain i.e. are not on blockchains.

The market value of the global equity market stood at 120 trillion USD as of November 2021 and the global bond market is also around that size or a little bigger. Apart from that real estate, commodities, etc add hundreds of trillion dollars in market value.

Why am I saying all this?

A new wave of growth for the web3 industry is likely to come by bringing traditional securities and assets on blockchain networks. How? With Tokenization.

Not only traditional securities, but Tokenization also has the potential to unlock illiquid assets such as trade receivables, freight invoices and make them tradable like never before.

While tokenization presents this huge opportunity, learning about tokenization can be challenging as it encompasses various disciplines apart from blockchain technology. This course is trying to fill the gap. This course not only covers the fundamentals of tokenization but also the capital market concepts and blockchain-related concepts to help you understand tokenization effectively.

This course also covers a comparison between issuance of Security Token Offerings i.e. STOs with IPOs and ICOs. Apart from that, this course ventures into various potential use cases of Tokenization in capital markets, real assets, lending, etc. industries.

Content