An overview of Bitsgap’s features and interface before you start using the tool

What you will learn

The Bitsgap interface

How to trade using advanced trading tools

How to create trading bots

And how to visualise their portfolio and trading history

Description

With hundreds of centralised exchanges and thousands of cryptocurrencies, it’s very hard to keep track of your investments, trades and bots. Bitsgap is able to unify all of these under one platform.

It is an all-in-one trading automation platform for bitcoin and other cryptocurrencies.

It helps you trade on multiple exchanges and quickly switch from one to the other, compare rates from all the markets and keep track of your investments (and portfolios). You can do manual trading (with stop loss, take profit and some other, more advanced, techniques), arbitrage (by exploiting price differences between portfolios) and it also features a demo mode to test everything before you use real money.

It also has trading bots that use automated algorithms to generate a profit without you having to manually login at 3 a.m. in the morning to monitor your trades.

The platform has been featured in a lot of articles in the crypto space including CoinGecko, AMB Crypto, Elite CurrenSea, BeInCrypto, RippleNews and CaptainAltcoin.

In this course I’ll walk you through Bitsgap’s interface and features.

Specifically:

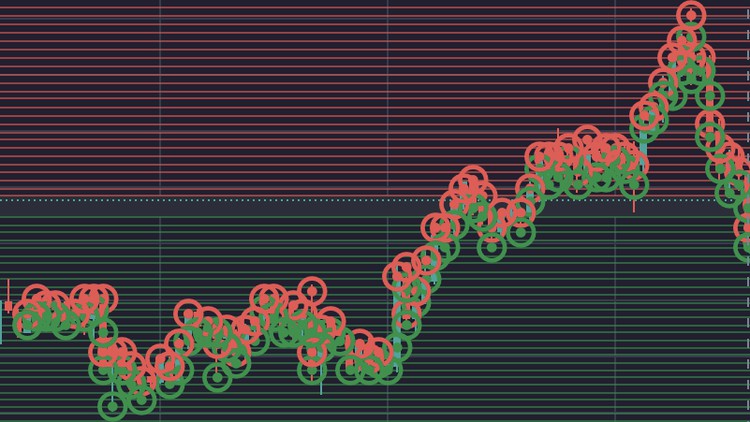

- How to use the chart tools to plot strategies on various cryptocurrencies

- How to create various types of orders (limit, market, stop, stop limit, shadow, TWAP, OCO and more)

- The very basics of arbitrage via Bitsgap’s interface

- How to start the 4 bots Bitsgap provides (Sbot, Classic bot, Scalper bot and Combo bot)

This course is not for someone interested in getting a quick strategy or learning trading techniques. It’s an overview of Bitsgap’s features and how to use its interface to do the things you already know how to do.

I can’t wait to see you on the other side!

Content