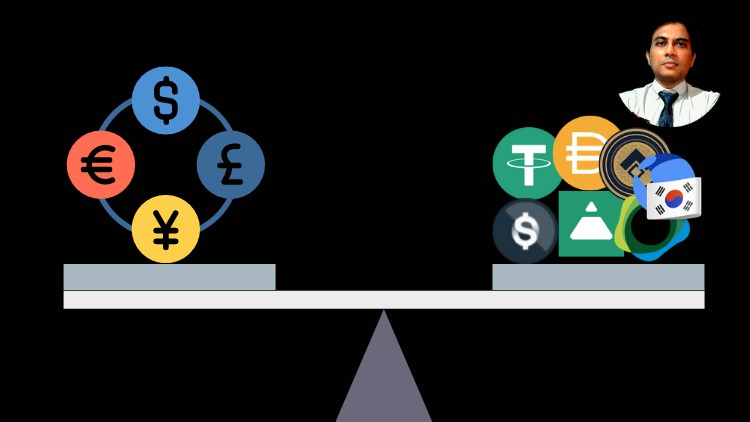

Learn basics of Stablecoins, Global Stablecoins, and Central Bank Digital Currencies. Impact on Global Financial Systems

What you will learn

Problems with using cryptocurrencies for payment and the need for Stablecoins.

What is a Stablecoin?

Types of Stablecoins – Asset-Backed and Algorithmic

Some Stablecoin Projects

Centralized and Decentralized Stablecoin Issuance

Stabilization mechanisms – Arbitrage and Algorithm based

Applications of Stablecoins

Investing in Stablecoins – Return and Risk sources

Global Stablecoin – Diem etc.

Central Bank Digital Currencies (CBDC)

Description

If you heard the term stablecoin but are not sure about how they work or how it can impact your industry, this course is for you.

Stablecoins are crypto-assets where the value is pegged to an external reference generally the price of a fiat currency such as a dollar or pound. Pegging means when an asset tries to maintain its price equal to the price of another asset.

Though Stablecoins represent only 10-15% of crypto assets in market value, they are responsible for 70-80% of the daily transaction value. It is because stablecoins offer various real-world use cases and the ability to integrate them into traditional i.e. fiat economy that most crypto-assets do not.

Stablecoins offer the prospect of solving some major economic problems – from drastically reducing cost and delay in global remittances, to reducing friction in global trade and creating truly global marketplaces to enabling automated recurring payments through DeFi – Stablecoins can dramatically change various industries.

At the same time, Stablecoins are posing various risks both for the holders of stablecoins and for the larger economic system.

This course covers various aspects of Stablecoins – from how they work to applications to various stablecoins projects to sources of return and risks in investing in stablecoins.

This course also discusses global stablecoins such as Diem from Facebook and covers Central Bank Digital Currencies.

So, let us get started on Stablecoins.

Content