Designing Robust Stablecoin Systems with Asset-Liability Management Concepts.

What you will learn

Why do some Stablecoins fail and others do not?

Understanding Stablecoin systems from an Asset-Liability Management perspective

Asset-Liability Management Process and Tools

Internal economics of Stablecoins.

Role of collateral and reserve in stablecoin systems.

The failure mode for various stablecoins

Stablecoin Bank-runs

Description

The collapse of TerraUSD and with that the whole Terra ecosystem comprising Luna Coins and Anchor protocol is a watershed moment in the history of digital assets. This can accelerate regulations in the sector and can significantly slow down the development of private digital assets.

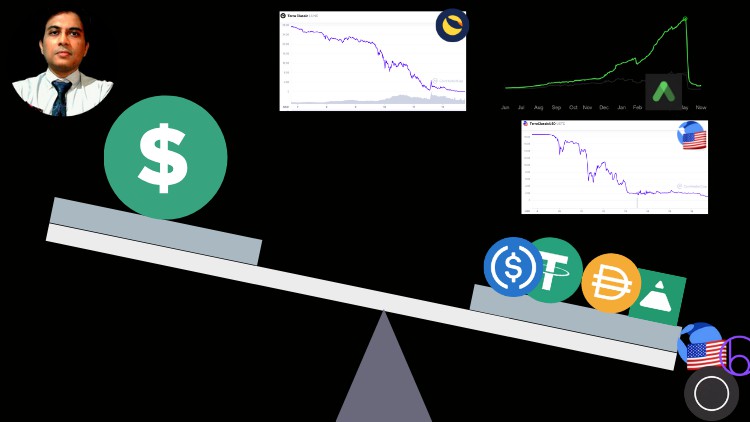

On 9th May 2022, TerraUSD or UST the USD pegged Stablecoin the Terra ecosystem lost its peg..its price deviated significantly from 1 USD and the slide continued for next few days – the price fell to less than half a penny…the depeg of TerraUSD caused a sell-off of the sister coin LUNA too.

A market cap of more than 40 billion USD was erased between TerraUSD and Luna Coins in just a few days. Apart from that other digital assets on the Terra platforms such as TerraKRW, Anchor Protocol, and Mirror Protocol assets …additional hundred of millions of dollars were lost if not billions more.

Now, there are two ways to react to it – either we can say that all stablecoins or even all crypto assets are worthless or try to understand why TerraUSD and some other stablecoins failed.

Just want to point out that even in this market turmoil many other stablecoins remained stable. That includes centralized fiat-backed stablecoins such as USDC and USDT and crypto collateralized decentralized stablecoins DAI. Even sUSD i.e. Synthetix USD on the Synthetix platform seems to gain stability after negligible volatility.

We should also note that TerraUSD is not the first stablecoin to fail. So, why did some Stablecoins fail and others survived.

This course will hopefully help you understand why stablecoins fail and how robust stablecoins systems can be developed using concepts of Asset-Liability Management.

This is my second course on Stablecoins. The first course covers the basics of stablecoins. This course is an intermediate-level course that delves into more intricate concepts. For sake of completeness, this course includes some basic concepts on Stablecoins too.

Content