Learn to trade the Donchian Channel LWMA Strategy for 87.2 % Return on Account. Indicators for download is included.

What you will learn

Trade the Donchian Channel LWMA strategy.

How to create a tradingplan.

Read and understand price charts.

Handle trading psychology.

Description

How to trade the Donchian Channel with the Linear Weighted Moving Average 4-hour strategy?

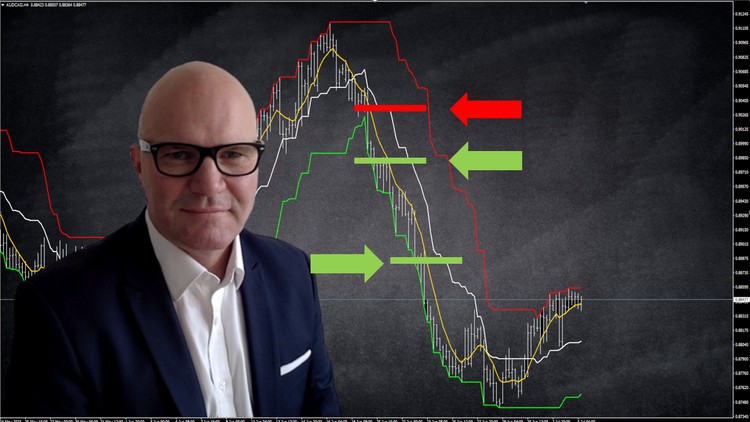

Trading strategies can be highly individualized, and the following is a generalized approach combining the Donchian Channel and the Linear Weighted Moving Average (LWMA) for a 4-hour timeframe strategy.

Here are the steps for implementing the Donchian Channel with the LWMA 4-hour strategy:

1. Set up the Donchian Channel: Calculate the upper channel line, lower channel line, and middle channel line based on a specified period. For this strategy, we use a 20-period Donchian Channel.

2. Set up the LWMA: For this strategy, we use a 10-period LWMA.

3. Identify bullish signals: Look for opportunities to enter long (buy) positions when the following conditions are met:

· The price touched the upper channel line of the Donchian Channel.

· The price of the LWMA above the 10-period indicator, indicating a bullish trend.

· Set the a stop-loss order below the middle line swing low.

4. Additionally, determine a profit target based on your risk-to-reward ratio. In this case 1:1.25

5. Identify bearish signals: Look for opportunities to enter short (sell) positions when the following conditions are met:

· The price toouches the lower channel line of the Donchian Channel.

· The price of the LWMA below the 10-period indicator, indicating a bearish trend.

· Set the a stop-loss order above the middle line swing low.

6. Additionally, determine a profit target based on your risk-to-reward ratio. In this case 1:1.25

7. Monitor and manage the trade: Once you have entered a trade, monitor it closely. You may consider adjusting the stop-loss and take-profit levels as the trade progresses, based on the evolving market conditions.

Remember that no trading strategy guarantees success, and it’s essential to practice risk management by controlling position sizes, using stop-loss orders, and avoiding overexposure to any single trade. Additionally, backtesting and demo trading can help you assess the effectiveness of the strategy before applying it to real-market conditions.

Content