Technical, Legal, and Commercial aspects of NFTs for proper Due Diligence

What you will learn

Legal and commercial aspects of NFT transactions

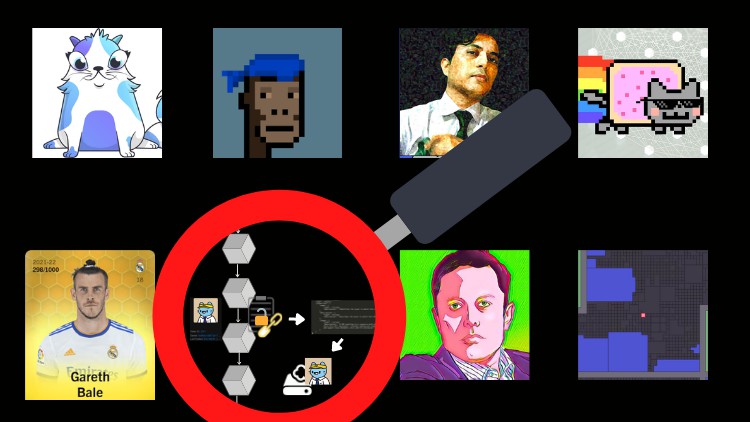

Fundamental nature of NFTs and NFT transactions.

Technology behind NFTs

NFT Due Dilligence

Different types of NFTs and their use

Return and Risk sources for investing in NFTs

Description

From merely 25 million USD in 2019 annual trading volume of NFT or Non-fungible tokens reached 17.7 billion in 2021.. which is more than 700 times in 2 years….and the average price of NFTs increased from merely 15 us dollars to more than 800 us dollars.

But amid all this exuberance, there are a lot of misconceptions about the very nature of NFTs and NFT transactions.

These misconceptions have created two distinct groups – advocates of NFTs who claim that NFTs are going to disrupt the creator economy..another group who think that the whole NFT system is fraudulent and compare it with the Tulip bubble.

As in the case of all things – the truth is somewhere in between and much more complex.

While the rapid increase in the trade price of NFTs points to a market driven by hype, the fundamental technology behind NFTs has tremendous potential in various industries.

Now, this course is designed for investors who are interested in adding NFTs to their portfolios but do not want to take impulsive decisions and want to perform proper due diligence. This course does not consider NFTs as a groundbreaking revolution nor as instruments to carry out fraud. This course considers NFTs as another type of prospective investment which needs to be understood not only from a return perspective but also from a risks and liability perspective.

Content