Master Copula Theory, Visualization, Estimation, Simulation, and Probability Calculations with the copula Package in R

What you will learn

Understand the fundamentals of copulas – Learn what copulas are, their mathematical properties, and their role in modeling dependence structures

Explore Sklar’s Theorem – Understand how joint cumulative distribution functions (CDFs) decompose into marginal distributions and a copula function

Learn different types of copulas – Study Gaussian, t-Student, Clayton, and Gumbel copulas and their characteristics

Estimate copula parameters in R – Use the copula package to estimate copula parameters through statistical methods

Perform goodness-of-fit tests – Assess the quality of fitted copula models using statistical criteria such as AIC, BIC, and log-likelihood

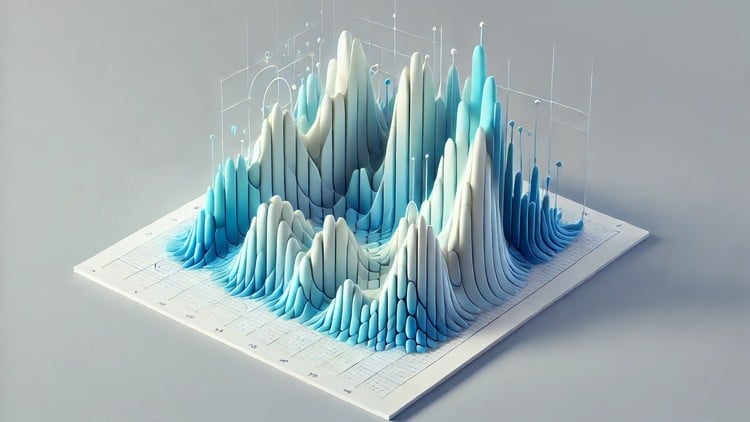

Visualize copulas in R – Generate contour plots, 3D surfaces, and scatter plots to interpret dependence structures

Simulate data using copulas – Use copulas to generate synthetic datasets that preserve the dependence structure of modeled data

Analyze dependencies – Compute Kendall’s Tau, Spearman’s Rho, and tail dependence coefficients to measure both typical and extreme event correlations

Add-On Information:

Note➛ Make sure your 𝐔𝐝𝐞𝐦𝐲 cart has only this course you're going to enroll it now, Remove all other courses from the 𝐔𝐝𝐞𝐦𝐲 cart before Enrolling!

- Gain the ability to model complex multivariate relationships, moving beyond linear correlation to capture crucial non-linear and asymmetric dependencies in diverse datasets.

- Unlock powerful techniques for analyzing extreme event correlations, providing critical insights for robust risk management in finance, insurance, and environmental science.

- Develop a strong practical toolkit for implementing sophisticated dependency models using R, translating theoretical understanding into immediate analytical skills.

- Equip yourself to design more accurate and resilient predictive models by incorporating nuanced dependency structures, leading to improved forecasting and decision-making.

- Explore how copulas serve as versatile building blocks in advanced statistical modeling, enabling the construction of flexible multivariate distributions tailored to complex data.

- Master the art of translating abstract mathematical concepts of dependency into intuitive visualizations, making complex relationships accessible and interpretable.

- Learn to identify and mitigate risks associated with interdependent variables, a vital skill for portfolio optimization, credit risk assessment, and operational resilience.

- Build foundational expertise in a cutting-edge statistical methodology increasingly valued across data science, quantitative finance, and research domains.

- Confidently approach challenges involving joint probability distributions, enabling precise calculations for scenarios like coincident failures or combined risk exposures.

- Enhance data generation capabilities by creating synthetic datasets that mimic observed dependency structures, invaluable for stress testing, simulation, and data augmentation.

- Understand the critical role of copulas in machine learning for feature engineering, boosting model performance by capturing complex interactions between features.

- Position yourself as an expert capable of tackling multivariate data analysis problems that conventional statistical methods often struggle to address.

- PROS:

- Practical Skill Enhancement: Focuses heavily on hands-on application with R, ensuring immediate usability of learned concepts in real-world scenarios.

- Advanced Analytical Edge: Provides a deep dive into a sophisticated statistical tool, giving participants a distinct advantage in tackling complex data challenges.

- Broad Applicability: Skills acquired are highly relevant across diverse sectors including finance, insurance, environmental science, and data science, expanding career opportunities.

- Beyond Basics: Moves past traditional correlation methods to equip users with tools for non-linear, asymmetric, and tail dependency modeling.

- CONS:

- Steep Learning Curve: As a “crash course,” it covers advanced topics rapidly, potentially challenging for individuals without a solid statistical or mathematical foundation.

English

language