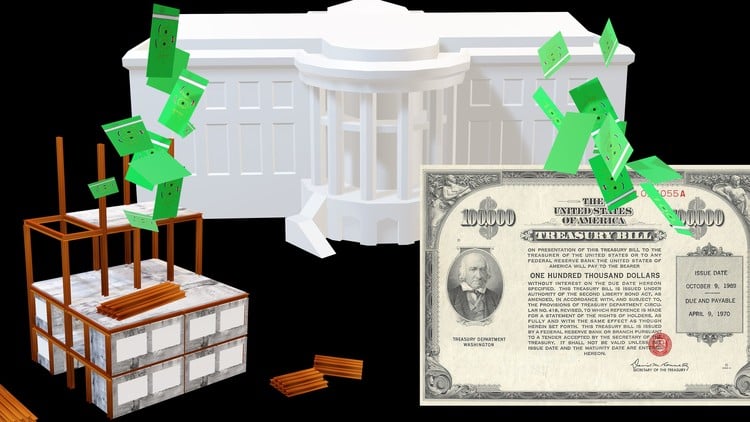

Governmental Accounting-Capital Projects Fund & Debts Service Fund-Long Term Capital Projects Transactions

⏱️ Length: 20.8 total hours

⭐ 4.58/5 rating

👥 43,612 students

🔄 September 2019 update

Add-On Information:

Note➛ Make sure your 𝐔𝐝𝐞𝐦𝐲 cart has only this course you're going to enroll it now, Remove all other courses from the 𝐔𝐝𝐞𝐦𝐲 cart before Enrolling!

-

Course Overview

- Introduces advanced governmental accounting, specifically focusing on the lifecycle of capital assets and their associated financing mechanisms.

- Explores the unique accounting and financial reporting requirements mandated by the Governmental Accounting Standards Board (GASB) for capital projects.

- Examines in detail the Capital Projects Fund, including its establishment, budgetary accounting, expenditure recognition, and closing procedures for multi-year projects.

- Analyzes the Debt Service Fund, covering the intricacies of accounting for general long-term debt, interest accruals, principal payments, and bond refunding.

- Understands the critical interplay between capital project financing, debt issuance, and their impact on both government-wide financial statements and fund-level reporting.

- Discusses common challenges and best practices in managing and reporting complex capital outlays and their long-term repayment obligations effectively.

- Provides insights into how governmental entities strategically plan, budget, and account for significant infrastructure investments that serve the public good over decades.

-

Requirements / Prerequisites

- Foundational Understanding of Governmental Accounting: Prior exposure to basic governmental accounting principles, including an understanding of fund accounting, different fund types (governmental, proprietary, fiduciary), and fundamental governmental financial statements. This course builds upon that core knowledge.

- Familiarity with GASB Concepts: A general awareness of the Governmental Accounting Standards Board (GASB) and its pivotal role in setting accounting and financial reporting standards for state and local governments.

- Intermediate Accounting Proficiency: A solid grasp of intermediate financial accounting concepts, including debits and credits, accrual accounting, and basic financial statement analysis.

- Analytical and Problem-Solving Aptitude: An ability to analyze complex financial scenarios, interpret regulations, and apply accounting rules to real-world governmental transactions, particularly those involving long-term financial commitments.

-

Skills Covered / Tools Used

- Fund Accounting Application: Proficiency in applying specific fund accounting principles to capital projects and debt service activities, distinguishing between governmental fund and government-wide financial statements.

- GASB Standard Interpretation: Ability to accurately interpret and apply relevant GASB pronouncements related to capital assets, long-term debt, and related financing, ensuring compliance in reporting.

- Budgetary Accounting for Capital Projects: Skill in preparing and managing budgetary entries for capital projects, understanding appropriations, encumbrances, and expenditures unique to the Capital Projects Fund.

- Debt Service Management and Accounting: Expertise in accounting for various types of governmental debt (e.g., general obligation bonds, revenue bonds, leases), focusing on principal, interest, and escrow accounts.

- Financial Statement Preparation: Capability to prepare relevant journal entries, ledger accounts, and contribute to the preparation of Comprehensive Annual Financial Report (CAFR) sections related to capital assets and long-term liabilities.

- Interfund Transaction Recognition: Understanding and correctly recording complex interfund transfers and loans that often occur between the General Fund, Capital Projects Fund, and Debt Service Fund.

- Capital Asset Reporting: Skills in properly classifying and reporting capital assets in government-wide financial statements, including capitalization policies and disclosure requirements.

- Data Analysis and Spreadsheeting: Practical application of spreadsheet software (e.g., Microsoft Excel) to manage debt amortization schedules, calculate interest, and reconcile capital project expenditures against budgets.

- Policy Implementation Understanding: Developing an understanding of how accounting policies are formulated and implemented within governmental entities to ensure consistent and compliant treatment of long-term assets and liabilities.

-

Benefits / Outcomes

- Enhanced Career Prospects: Position yourself for specialized roles in governmental finance, auditing, or consulting, where expertise in capital project and debt accounting is highly valued.

- Deepened Industry Knowledge: Gain a comprehensive understanding of the financial backbone of public infrastructure development and maintenance, offering insights crucial for civic planning and resource allocation.

- Compliance Assurance: Develop the ability to ensure governmental entities comply with strict GASB standards, mitigating financial risks and enhancing accountability to taxpayers and stakeholders.

- Effective Resource Management: Learn to track and manage significant public funds allocated for major construction or acquisition projects, optimizing spending and safeguarding public assets.

- Informed Decision-Making: Acquire the financial acumen necessary to contribute to strategic decisions regarding debt issuance, capital budgeting, and long-term financial planning for government entities.

- Improved Financial Reporting Quality: Master the nuances of preparing accurate and transparent financial statements specifically for capital projects and debt, boosting the credibility and reliability of governmental reports.

- Professional Development: Fulfill continuing professional education requirements or enhance your credentials in governmental accounting, demonstrating a commitment to advanced specialization.

- Public Sector Impact: Understand how robust governmental accounting practices contribute to fiscal health, transparency, and the long-term sustainability of public services and infrastructure.

-

PROS

- Specialized Focus: Delivers a deep dive into two critical and complex areas of governmental accounting, often overlooked in more general courses, providing niche expertise.

- Practical Relevance: Directly addresses real-world challenges faced by state and local governments in financing and managing major capital investments and their associated debt.

- Career Advancement: Equips learners with highly in-demand skills for specialized roles in municipal finance, audit firms, and various government agencies, setting them apart in the job market.

- Expert-Led Content: Benefits from the implied expertise of the course creator, given the specific, advanced nature and comprehensive scope of the topics covered.

-

CONS

- Requires Prior Knowledge: Not suitable for absolute beginners in accounting or governmental finance, as it demands a solid foundational understanding of core principles to succeed effectively.

Learning Tracks: English,Finance & Accounting,Accounting & Bookkeeping

Found It Free? Share It Fast!