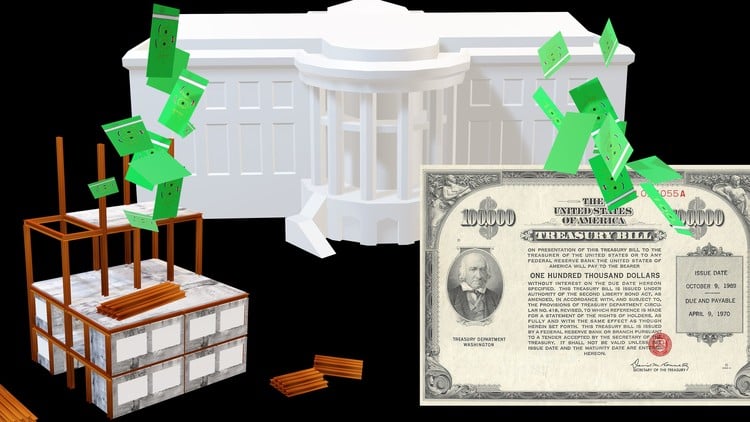

Governmental Accounting-Capital Projects Fund & Debts Service Fund-Long Term Capital Projects Transactions

⏱️ Length: 20.8 total hours

⭐ 4.67/5 rating

👥 43,409 students

🔄 September 2019 update

Add-On Information:

Note➛ Make sure your 𝐔𝐝𝐞𝐦𝐲 cart has only this course you're going to enroll it now, Remove all other courses from the 𝐔𝐝𝐞𝐦𝐲 cart before Enrolling!

-

Course Overview

- Dive into the specialized world of governmental financial management, specifically focusing on the lifecycle of major public infrastructure initiatives and their associated long-term financing.

- Uncover the unique accounting principles governing Capital Projects Funds, understanding how governments track the acquisition or construction of significant assets like new schools, roads, or municipal buildings from inception to completion.

- Explore the intricate mechanisms of the Debt Service Fund, a critical component for managing the repayment obligations arising from bond issuances and other long-term governmental debt, ensuring fiscal responsibility and public trust.

- Gain a profound understanding of the distinct measurement focus and basis of accounting employed by governmental funds (modified accrual) versus the government-wide financial statements (full accrual), crucial for comprehensive reporting.

- Appreciate the paramount importance of interperiod equity in governmental accounting – the concept that current citizens should bear the cost of current services, including the long-term assets they benefit from.

- Learn how public sector entities adhere to legal and budgetary compliance when undertaking substantial capital expenditures, reflecting the fiduciary responsibility to taxpayers and bondholders.

- Analyze the strategic implications of financing choices for capital projects, moving beyond mere recording to understanding the impact of debt structures on a government’s fiscal health and future borrowing capacity.

-

Requirements / Prerequisites

- A foundational understanding of basic accounting principles, including the accounting equation, debits, and credits.

- Familiarity with the general purpose of financial statements (Balance Sheet, Income Statement, Cash Flow Statement).

- An introductory grasp of governmental accounting concepts, particularly the fund accounting structure and the distinction between governmental and proprietary funds, would be highly beneficial.

- A keen analytical mindset and attention to detail are essential for navigating complex governmental transactions and reporting requirements.

- Access to standard spreadsheet software (e.g., Microsoft Excel, Google Sheets) for practical exercises and hypothetical scenario analysis.

-

Skills Covered / Tools Used

- Develop expertise in interpreting Governmental Accounting Standards Board (GASB) pronouncements relevant to capital assets and long-term debt, enabling accurate application of reporting rules.

- Master the ability to differentiate and reconcile interfund activities involving the Capital Projects Fund, Debt Service Fund, and the General Fund, ensuring complete and coherent financial reporting.

- Acquire practical skills in preparing journal entries for a wide array of capital project transactions, from expenditure recording to project closeout and asset capitalization.

- Learn to effectively budget for capital outlays and debt service payments, contributing to sound financial planning and resource allocation within governmental entities.

- Enhance your capability to analyze financial data related to municipal bonds and other financing instruments, assessing their impact on government-wide financial positions.

- Cultivate the skill of crafting clear and compliant financial narratives that explain complex capital project and debt service activities to diverse stakeholders, including citizens, oversight bodies, and investors.

- Gain proficiency in conceptually applying general ledger system functionalities for specific governmental fund accounting scenarios.

-

Benefits / Outcomes

- Position yourself as a valuable asset in the public sector, equipped with specialized knowledge critical for governmental accounting roles.

- Enhance your career trajectory by mastering distinct and in-demand skills in governmental financial reporting and management.

- Contribute meaningfully to public accountability and transparency by accurately tracking and reporting on significant public investments and their financing.

- Develop a comprehensive understanding of how large-scale public projects are funded, managed, and accounted for, influencing strategic public policy decisions.

- Be better prepared for sections of professional certification exams (e.g., CPA Exam – Governmental and Not-for-Profit Accounting) that cover capital projects and debt service.

- Gain confidence in discussing and analyzing governmental financial statements, providing critical insights into a government’s long-term financial health.

- Build the expertise to oversee or audit the financial aspects of multi-million or billion-dollar public infrastructure developments.

-

PROS

- Highly specialized content directly applicable to governmental accounting careers.

- Addresses a critical area of public finance often overlooked in general accounting curricula.

- Practical, transaction-based learning approach that builds real-world competency.

- Excellent rating and high student enrollment indicate a well-regarded and effective course.

- Offers a deep dive into GASB standards relevant to capital assets and long-term liabilities.

-

CONS

- The specialized nature means the content may be less relevant for those not pursuing a career in government or non-profit accounting.

Learning Tracks: English,Finance & Accounting,Accounting & Bookkeeping

Found It Free? Share It Fast!