Learn in Detail, the Big 4 Key Bullish & Bearish Candle Patterns. Know How to do Money Management & Risk Management.

⏱️ Length: 13.2 total hours

⭐ 4.59/5 rating

👥 48,878 students

🔄 September 2024 update

Add-On Information:

Note➛ Make sure your 𝐔𝐝𝐞𝐦𝐲 cart has only this course you're going to enroll it now, Remove all other courses from the 𝐔𝐝𝐞𝐦𝐲 cart before Enrolling!

- Course Overview

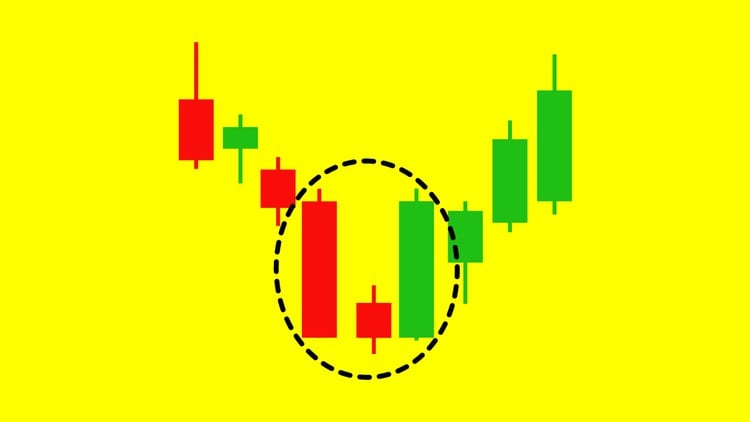

- This comprehensive ‘Level 1 – Japanese Candlesticks Trading Mastery Program’ serves as an indispensable gateway for aspiring traders and investors seeking to decipher the intricate language of price action. Delve into the rich historical context and enduring relevance of Japanese candlestick charting, a powerful visual methodology that has informed trading decisions for centuries. Far beyond simply identifying patterns, this program cultivates a deep understanding of the market psychology embedded within each candle formation, empowering you to anticipate potential market reversals, continuations, and periods of indecision. You will learn to perceive the subtle tug-of-war between buyers and sellers, translating this visual information into actionable trading insights across various financial instruments and timeframes. The curriculum is meticulously structured to provide a robust foundational knowledge, ensuring that participants not only recognize key patterns but also grasp the underlying market forces that give them significance. This program bridges the gap between raw price data and informed trading strategies, preparing you to interpret market movements with a discerning eye.

- The course emphasizes a holistic approach to trading, integrating advanced pattern recognition with crucial elements of financial prudence. It moves beyond mere technical analysis to instill a disciplined framework for capital preservation and growth. You’ll gain clarity on how to blend candlestick signals with sound quantitative principles, transforming speculative trading into a systematic endeavor. By understanding the core tenets of market behavior through the lens of candlesticks, you’ll develop a critical analytical skill set that is portable across different market environments, from volatile assets to more stable securities. This program is designed to equip you with the initial mastery required to navigate financial markets confidently, laying a strong groundwork for any future advanced trading studies.

- Requirements / Prerequisites

- No prior formal trading experience is strictly required, making this program accessible to complete beginners eager to learn about financial markets. A fundamental understanding of basic economic concepts and financial terminology, while beneficial, is not mandatory as the course builds from the ground up.

- Participants should possess a reliable internet connection and basic computer literacy to access course materials, navigate online platforms, and engage with charting software.

- A genuine interest in financial markets, a willingness to commit dedicated study time (approximately 13.2 hours of content plus practice), and a disciplined mindset are essential for maximizing learning outcomes and successful application of the strategies taught.

- Access to a charting platform (many free options are available) for practical application and observation of live market data is highly recommended to solidify theoretical knowledge through hands-on experience.

- Skills Covered / Tools Used

- Advanced Candlestick Pattern Interpretation: Develop the ability to not just identify patterns, but to understand their implications in various market contexts, including their strength, reliability, and potential for trend reversal or continuation, moving beyond simple memorization.

- Market Sentiment Analysis: Learn to infer the underlying sentiment of buyers and sellers directly from the visual cues provided by individual candles and their sequences, gaining an edge in predicting short-term price movements.

- Strategic Trade Entry & Exit Point Identification: Master the skill of using candlestick patterns as precise triggers for initiating new trades or closing existing positions, optimizing timing for potential profitability and risk mitigation.

- Effective Position Sizing Techniques: Acquire the knowledge to determine the appropriate quantity of shares or contracts to trade for any given setup, aligning trade size with your overall capital and predefined risk tolerance. This is crucial for long-term account growth.

- Chart Analysis Platforms: Gain familiarity with common trading software interfaces (e.g., TradingView, MetaTrader, etc.) to apply candlestick analysis effectively on live market charts, customizing views and settings to enhance readability and analysis.

- Development of a Disciplined Trading Mindset: Cultivate the psychological resilience and focus necessary to execute trading plans consistently, manage emotional responses to market fluctuations, and adhere strictly to risk and money management rules.

- Benefits / Outcomes

- Upon completion, you will possess a robust analytical framework for interpreting price action, empowering you to make more informed and less emotional trading decisions across diverse financial markets.

- You will develop a systematic approach to trading that integrates technical pattern recognition with prudent financial management, significantly enhancing your potential for capital preservation and growth.

- Gain the confidence to identify high-probability trading setups independently, minimizing reliance on external tips or complex indicators, and building your own unique market perspective.

- Establish a solid foundation in core trading principles that serves as an excellent springboard for pursuing more advanced trading strategies and specialized market analysis in the future.

- Acquire practical skills to structure your trades with clear entry, exit, and stop-loss levels, fostering a disciplined trading habit that prioritizes capital protection while seeking profitable opportunities.

- Elevate your understanding of market dynamics by connecting candlestick patterns to the ebb and flow of supply and demand, providing a clearer insight into where price might move next.

- PROS

- Boasts an exceptionally high student satisfaction rating of 4.59/5 from a massive student body of 48,878, indicating proven educational value and effectiveness.

- Offers a substantial 13.2 hours of detailed content, ensuring comprehensive coverage of foundational candlestick analysis and crucial trading principles.

- Regularly updated content (September 2024 update) guarantees relevance and alignment with current market practices and insights.

- Provides actionable strategies and essential risk/money management frameworks, directly addressing two of the most critical components for long-term trading success.

- The “Level 1” designation clearly positions it as an excellent starting point for beginners while still offering depth for those with some nascent market interest.

- CONS

- As with all trading education, successful application of learned strategies in real-world markets inherently involves financial risk, and individual results can vary significantly based on execution, market conditions, and personal psychological discipline.

Learning Tracks: English,Finance & Accounting,Investing & Trading

Found It Free? Share It Fast!