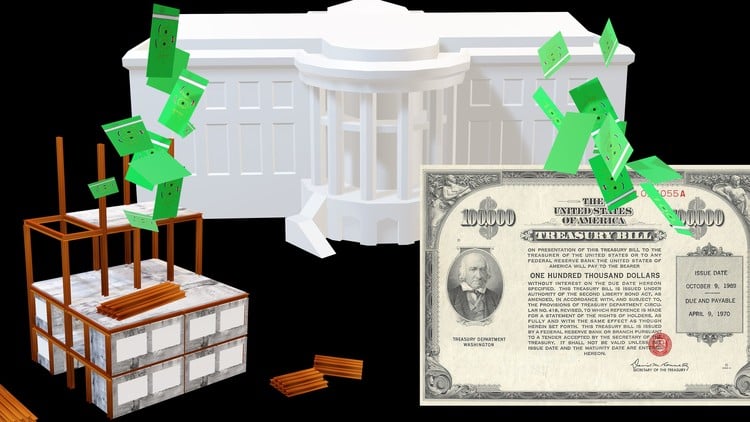

Governmental Accounting-Capital Projects Fund & Debts Service Fund-Long Term Capital Projects Transactions

⏱️ Length: 20.8 total hours

⭐ 4.62/5 rating

👥 43,271 students

🔄 September 2019 update

Add-On Information:

Note➛ Make sure your 𝐔𝐝𝐞𝐦𝐲 cart has only this course you're going to enroll it now, Remove all other courses from the 𝐔𝐝𝐞𝐦𝐲 cart before Enrolling!

- Course Overview

- This course offers an intensive exploration into the specialized financial management of governmental capital projects, distinguishing them from routine operational expenditures. It illuminates the intricate landscape where public funds are allocated for significant, long-term investments in infrastructure, facilities, and technology, often spanning multiple fiscal periods and necessitating substantial financing.

- Gain a profound understanding of the dual-fund structure employed: the Capital Projects Fund, designed for resources and disbursements related to major capital asset acquisition or construction; and the Debt Service Fund, established for accumulating resources and paying general long-term debt principal and interest.

- Appreciate the critical role these funds play in ensuring fiscal transparency and accountability in the public sector, detailing unique challenges including political sensitivity, vast scale, and adherence to strict budgetary and legal compliance requirements.

- Examine the full lifecycle of a capital project, from initial authorization and financing through completion and ongoing debt management, understanding impacts on broader governmental financial statements and overall fiscal health.

- Requirements / Prerequisites

- Foundational Accounting Knowledge: A solid grasp of basic financial accounting principles, including the accounting equation, debits and credits, journal entries, and core financial statements, is crucial.

- Introduction to Governmental Accounting: Prior exposure to an introductory governmental accounting course or general understanding of the GASB framework, fund accounting, measurement focus, and basis of accounting specific to governmental entities is highly beneficial.

- Analytical Aptitude: Essential for critically analyzing complex financial scenarios, interpreting governmental regulations, and understanding multi-faceted transaction implications across different funds.

- Basic Spreadsheet Proficiency: A working knowledge of spreadsheet applications (e.g., Microsoft Excel) for organizing data, calculations, and basic financial modeling will be advantageous.

- Commitment to Detail: Governmental accounting demands meticulous attention to detail due to its highly regulated nature and precision requirements for public funds.

- Skills Covered / Tools Used

- Fiscal Stewardship & Resource Management: Develop a deeper understanding of principles guiding responsible allocation and management of public financial resources for long-term capital investments and associated debt.

- Regulatory Compliance Interpretation: Sharpen your ability to interpret and apply complex governmental accounting standards (GASB) relating to capital asset acquisition, construction, financing, and debt servicing.

- Strategic Financial Planning for Public Entities: Learn to evaluate and contribute to the long-term financial planning processes of governmental units, particularly concerning major project funding and sustainable public debt portfolio management.

- Inter-fund Relationship Analysis: Cultivate the skill to analyze and articulate intricate relationships and transfers between governmental funds (General, Capital Projects, Debt Service) during a capital endeavor’s lifecycle.

- Public Finance Communication: Enhance capacity to communicate complex financial information related to capital projects and debt service to diverse stakeholders, promoting transparency and informed decision-making.

- Benefits / Outcomes

- Enhanced Career Versatility: Position yourself as a valuable asset in public sector roles like governmental auditors, financial managers, and budget analysts, by mastering this critical, highly sought-after area of public finance.

- Informed Public Policy Contribution: Gain expertise to actively participate in and influence public policy discussions related to infrastructure development, public spending, and long-term fiscal planning within governmental entities.

- Improved Financial Oversight Capabilities: Acquire skills to provide robust oversight of public funds, ensuring capital projects are executed efficiently, within budget, and in full compliance, safeguarding taxpayer interests.

- Strategic Debt Management Acumen: Understand nuances of governmental debt issuance and repayment strategies, enabling contribution to decisions promoting fiscal sustainability and responsible long-term financial health.

- Confidence in Complex Reporting: Develop confidence to navigate and contribute to the preparation and interpretation of Comprehensive Annual Financial Reports (CAFRs), specifically pertaining to capital assets and long-term liabilities.

- PROS

- Highly Specialized and In-Demand Knowledge: Focuses on a critical and complex area of governmental finance, making graduates particularly valuable in public sector accounting roles.

- Real-World Application: Directly addresses transactions and scenarios encountered daily by governmental entities, offering practical and immediate applicability to professional duties.

- Comprehensive Fund Accounting Coverage: Provides an exhaustive examination of the Capital Projects and Debt Service Funds, ensuring a deep understanding of their unique accounting requirements.

- Reinforces Fiscal Responsibility: Emphasizes accountability, transparency, and sound financial management practices in the context of public spending and debt.

- Career Advancement Potential: Equips learners with advanced skills that can lead to promotion, increased responsibilities, and higher-level positions within governmental finance departments or auditing firms.

- Solid Foundation for Further Study: Serves as an excellent building block for those wishing to pursue advanced certifications or further education in public administration or finance.

- CONS

- Demanding Learning Curve: The intricate rules and numerous exceptions within governmental accounting, especially concerning multi-fund transactions and GASB standards, can present a significant challenge requiring diligent study and consistent practice.

Learning Tracks: English,Finance & Accounting,Accounting & Bookkeeping

Found It Free? Share It Fast!