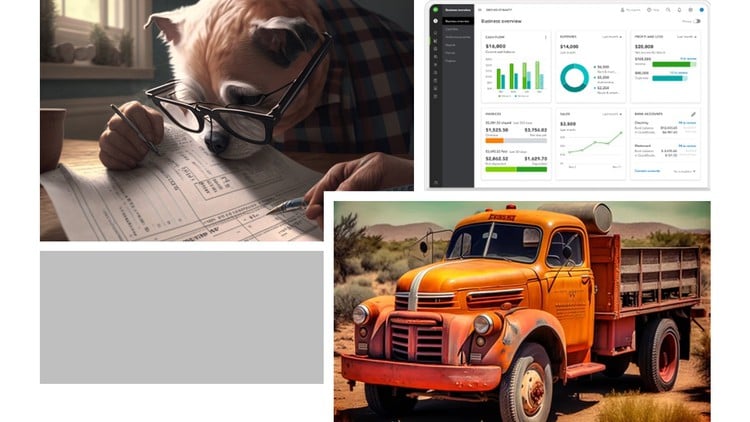

Unlock Efficient Tax Management: Mileage Tracking, Home Office Deductions, and Receipts Management with QuickBooks

⏱️ Length: 6.3 total hours

⭐ 4.69/5 rating

👥 9,052 students

🔄 June 2023 update

Add-On Information:

Note➛ Make sure your 𝐔𝐝𝐞𝐦𝐲 cart has only this course you're going to enroll it now, Remove all other courses from the 𝐔𝐝𝐞𝐦𝐲 cart before Enrolling!

- Course Overview

- This essential course is designed for US-based small business owners, freelancers, and self-employed individuals eager to master tax deductions. It meticulously guides you through leveraging QuickBooks Online’s features to strategically identify, track, and categorize eligible expenses for significant tax savings. You’ll gain a profound understanding of how QBO’s integrated financial management directly translates into reduced taxable income, empowering proactive financial control.

- Demystify the often-complex world of US tax deductions by learning to transform consistent, accurate financial data entry into a powerful year-end tax optimization strategy. This program tackles the common challenges of manual tracking and scattered documentation, providing a streamlined, digital approach that saves time and reduces potential audit risks.

- Embrace a proactive approach to tax management, moving beyond last-minute scrambles. The curriculum instills best practices for maintaining an organized, audit-ready financial system using QuickBooks Online, turning accounting from a chore into a strategic advantage for sustainable growth and legitimate tax minimization.

- Requirements / Prerequisites

- Basic Computer Literacy: Fundamental comfort with web navigation and standard computer applications is necessary.

- Access to QuickBooks Online: An active subscription or trial version is highly recommended for hands-on practice and immediate application of learned concepts.

- Foundational Business Understanding: A general awareness of business income and expenses will provide context, though no prior accounting or tax expertise is expected.

- Commitment to Organization: A willingness to implement structured expense tracking processes is key to maximizing your learning and potential tax savings.

- Skills Covered / Tools Used

- Strategic Expense Categorization: Develop expertise in applying IRS-compliant categories within QuickBooks Online, ensuring optimal classification for every deductible item.

- Automated Transaction Import: Master QBO’s features for automatically importing bank and credit card transactions, vastly reducing manual entry and enhancing data accuracy.

- QuickBooks Online Mobile App Proficiency: Learn to utilize the mobile app for efficient on-the-go receipt capture, mileage logging, and expense recording, ensuring no deduction is overlooked.

- Custom Tax Report Generation: Acquire the ability to produce specific QuickBooks reports vital for tax preparation, providing clear, organized data for self-filing or your accountant.

- Digital Document Management: Implement a robust system for attaching digital copies of receipts and relevant documents directly to transactions, creating a solid audit trail.

- Disciplined Financial Habit Formation: Cultivate ongoing expense tracking and financial review habits, fostering a proactive approach to fiscal health.

- Benefits / Outcomes

- Maximized Tax Savings: Confidently identify and claim all eligible US tax deductions, directly leading to lower taxable income and improved business cash flow.

- Minimized Audit Risk: Establish an impeccably organized and well-documented financial system within QuickBooks Online, providing a robust audit trail and reducing IRS inquiry stress.

- Enhanced Financial Insight: Gain a clear, real-time understanding of your business’s profitability through accurate income and expense tracking, supporting more informed strategic decisions.

- Significant Time Savings: Streamline record-keeping processes, freeing up valuable hours previously spent on manual documentation to reinvest in business growth or personal pursuits.

- Increased Confidence: Approach tax season with assurance, knowing your QuickBooks Online data is accurate, complete, and optimized for maximum tax advantage, alleviating year-end anxiety.

- Empowered Business Management: Transform into a knowledgeable manager, understanding the direct link between daily operational expenses and year-end tax liabilities, taking active control.

- PROS

- Direct Financial Impact: Delivers immediate, quantifiable financial benefits through legitimate tax deduction optimization, improving your bottom line.

- Highly Practical and Actionable: Content is designed for immediate implementation, allowing learners to apply strategies directly within their own QuickBooks Online accounts.

- Reduces Reliance on External Professionals: Empowers business owners to manage core expense tracking and deduction identification, potentially lowering tax preparation costs.

- Up-to-Date Content: Focuses on current QuickBooks Online features and relevant US tax deduction guidelines, ensuring modern applicability.

- CONS

- Software Dependency: The course’s techniques and benefits are intrinsically linked to an active QuickBooks Online subscription, limiting relevance for users of alternative accounting software.

Learning Tracks: English,Finance & Accounting,Taxes

Found It Free? Share It Fast!