Learn in Detail, the Big 4 Key Bullish & Bearish Candle Patterns. Know How to do Money Management & Risk Management.

⏱️ Length: 13.2 total hours

⭐ 4.61/5 rating

👥 48,052 students

🔄 September 2024 update

Add-On Information:

Note➛ Make sure your 𝐔𝐝𝐞𝐦𝐲 cart has only this course you're going to enroll it now, Remove all other courses from the 𝐔𝐝𝐞𝐦𝐲 cart before Enrolling!

-

Course Overview

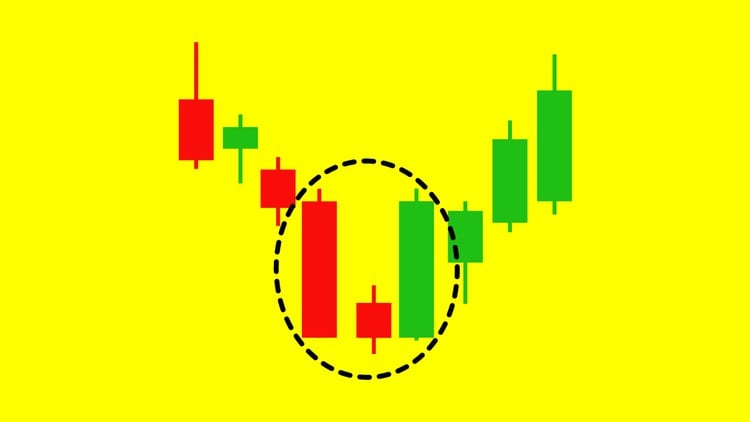

- Embark on a Foundational Journey: This ‘Level 1’ program serves as your definitive entry point into the dynamic world of technical analysis, focusing on Japanese Candlesticks—a time-tested method for interpreting market sentiment and price action. It’s designed to build a robust understanding from the ground up, ensuring a solid base for all future trading endeavors.

- Unlocking Market Psychology: Delve beyond simple chart patterns to comprehend the underlying psychological battles between buyers and sellers that each candlestick visually represents. Learn to decode these visual narratives to gain a significant edge in predicting future price movements.

- Strategic Pattern Recognition: While the course covers specific key patterns, the overarching goal is to cultivate a keen eye for recognizing recurring market behavior through candlestick formations. Develop the ability to spot high-probability setups by understanding the context in which these patterns emerge.

- Integrating Core Financial Disciplines: Beyond pattern identification, this mastery program deeply integrates the indispensable disciplines of money management and risk management. Understand why consistent profitability hinges not just on what you trade, but how you manage your capital and protect against adverse market moves.

- A Practical, Step-by-Step Approach: Designed for absolute beginners yet comprehensive enough for those looking to solidify their understanding, the program guides you through a logical progression of concepts. Each module builds upon the last, culminating in a holistic framework for informed decision-making.

- Cultivating a Trader’s Mindset: Discover how to approach the markets with discipline and a strategic perspective, moving beyond impulsive trading based on emotion. The program emphasizes building a structured approach to market analysis and trade execution.

-

Requirements / Prerequisites

- No Prior Trading Experience Necessary: This ‘Level 1’ course is explicitly designed for individuals with little to no prior exposure to financial markets or technical analysis. All fundamental concepts are introduced and explained in detail.

- Basic Computer Literacy: Familiarity with navigating web browsers and operating a personal computer or laptop is expected, as the course is delivered online.

- Reliable Internet Connection: A stable internet connection is essential for accessing course materials, streaming video lectures, and participating in any online activities.

- Commitment to Learning: A genuine willingness to learn, practice, and apply the concepts taught is the most crucial prerequisite. Success in trading requires dedication and consistent effort.

- Access to a Charting Platform (Free Options Available): While not strictly a prerequisite for *starting* the course, students will eventually benefit from accessing a live or historical charting platform (many free versions exist) to practice identifying patterns and applying risk/money management principles.

- Open Mind and Patience: Trading mastery is a journey, not a destination. Approaching the material with an open mind and the patience to develop new skills will significantly enhance your learning experience.

-

Skills Covered / Tools Used

- Advanced Candlestick Interpretation: Develop the nuanced skill of reading individual candlesticks and multi-candlestick patterns to infer immediate market sentiment, momentum shifts, and potential reversals or continuations.

- Market Sentiment Analysis: Learn to gauge the prevailing bullish or bearish sentiment in any market timeframe purely from candlestick formations, enabling you to align your trades with dominant market forces.

- Strategic Entry and Exit Point Identification: Master the art of using candlestick signals to pinpoint high-probability entry points for new trades and intelligent exit points for managing existing positions, maximizing potential gains while minimizing losses.

- Effective Position Sizing: Acquire the crucial skill of calculating appropriate position sizes for each trade, directly impacting your overall risk exposure and capital preservation. This is a cornerstone of sustainable trading.

- Dynamic Risk Management Protocols: Implement structured methods for defining and controlling your maximum permissible loss per trade and across your entire trading portfolio, safeguarding your capital from significant drawdowns.

- Capital Growth Optimization: Understand and apply principles of money management that aim not just to protect your capital, but also to facilitate its consistent growth over time through prudent allocation and compounding.

- Probability-Based Trading Mindset: Shift your perspective from predicting individual trades to understanding the statistical edge of your trading system, embracing the concept that consistent profitability comes from managing probabilities over a series of trades.

- Charting Software Navigation (Conceptual): While specific software isn’t taught, the principles are universally applicable, allowing you to effectively utilize any standard charting platform to identify patterns and apply analytical techniques.

- Trade Planning & Execution Framework: Learn to develop a comprehensive trade plan that integrates candlestick analysis with risk and money management, providing a clear roadmap for every trade from conception to completion.

-

Benefits / Outcomes

- Confidently Interpret Price Action: Upon completion, you will possess the ability to confidently look at any price chart and understand the narrative unfolding, making you less reliant on lagging indicators or external ‘tips’.

- Reduced Emotional Trading: By establishing clear rules for trade entry, exit, and risk management, you will significantly minimize emotional decisions that often lead to poor trading outcomes.

- Enhanced Capital Preservation: The robust risk and money management strategies taught will empower you to protect your trading capital more effectively, ensuring longevity in the markets even during challenging periods.

- Improved Trade Selection: You’ll gain the discernment to identify higher-probability trade setups using candlestick patterns, leading to more informed and potentially profitable trading decisions.

- Development of a Sustainable Trading Edge: This program provides the foundational knowledge to build and refine a personal trading edge, allowing you to approach the markets systematically and strategically.

- Ability to Design Your Own Trading Strategy: With a deep understanding of candlesticks, risk, and money management, you will be equipped to begin constructing and testing your own effective trading strategies tailored to your style.

- Increased Trading Discipline: The structured approach to risk and money management instills invaluable discipline, a critical trait for any successful trader.

- Foundation for Advanced Technical Analysis: This ‘Level 1’ course provides an unparalleled foundation, preparing you for more advanced technical analysis concepts and trading strategies in the future.

-

PROS

- Highly Rated & Widely Popular: With a 4.61/5 rating from 48,052 students, the course demonstrates proven effectiveness and widespread student satisfaction.

- Regularly Updated Content: The September 2024 update ensures that the material remains current and relevant with the latest market insights and best practices.

- Comprehensive Foundational Knowledge: Offers a deep dive into two critical aspects of trading – candlestick analysis and indispensable risk/money management – making it a complete beginner’s package.

- Practical & Actionable Insights: The focus is on practical application, enabling students to immediately apply learned concepts to real-world trading scenarios.

- Accessible for All Levels: Specifically designed as ‘Level 1’, it caters perfectly to complete beginners while also offering valuable reinforcement for those with some prior experience.

-

CONS

- Requires Consistent Practice: While the course provides excellent theoretical knowledge, successful application and mastery require significant personal practice and market experience beyond the course material.

Learning Tracks: English,Finance & Accounting,Investing & Trading

Found It Free? Share It Fast!