Learn how to build a Long/Short Equity Portfolio following the lessons from Julian Robertson and his protégés

What you will learn

☑ Build a long/short equity portfolio

☑ Pick stocks to buy and short sell

Description

I’m on Udemy to share what I learnt about Hedge Funds and their strategies in the last 7 years.

This course is about the Long/Short equity approach, here I explain how hedge fund managers evaluate investment opportunities and build a portfolio that will have returns that will be fully or partially uncorrelated to the general stock market.

This is my first course and, because of short length and poor quality, I’m giving it away for free. If you want to make other courses possible consider living a five-stars review.

This course is intended for students interested in getting into the financial industry, for markets enthusiasts that want to replicate these strategies for their own personal portfolios or even for people looking into starting their own hedge fund in the future!

I’m giving for granted that you know basic financial concepts such as short selling, net income, free cash flow and leverage. If these terms are not familiar to you, you may consider watching some YouTube video about these concepts or search them on Investopedia!

I will also give you an exhaustive list of sources that I used for this course such as books, YouTube videos, podcasts and articles. After reading a bunch of textbooks and listening to podcasts and audiobooks I’m now condensing in this course several thousand hours of learning about the markets and the few professionals that managed to outperform them.

English

Language

Content

Full free course

Introduction to the Long/Short Equity approach

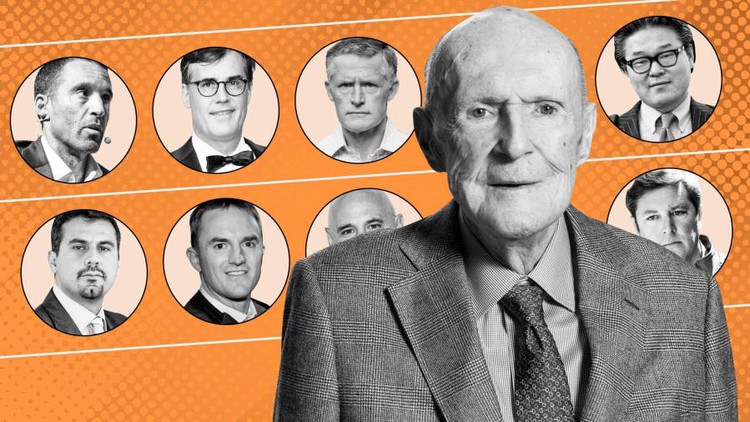

Lessons from Julian Robertson and the Tiger cubs

Additional resources

Julian Robertson interview

Philippe Laffont interview – CEO and Founder of Coatue Management – Part 1

Philippe Laffont interview – CEO and Founder of Coatue Management – Part 2