QuickBooks Online Beginner’s Guide of the 10 Essential Steps for New Business Owners

⏱️ Length: 31 total minutes

⭐ 4.38/5 rating

👥 1,379 students

🔄 September 2025 update

Add-On Information:

Note➛ Make sure your 𝐔𝐝𝐞𝐦𝐲 cart has only this course you're going to enroll it now, Remove all other courses from the 𝐔𝐝𝐞𝐦𝐲 cart before Enrolling!

- Course Overview

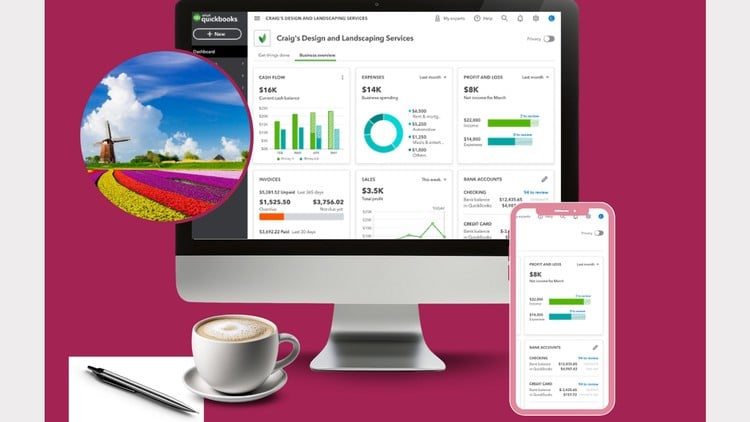

- This comprehensive 31-minute training module, updated in September 2025, is meticulously designed to demystify QuickBooks Online for novice users, particularly new business owners.

- Leveraging a proven 10-step methodology, the course navigates participants through the foundational aspects of the platform, transforming initial setup from a daunting task into an manageable process.

- It focuses on building confidence and competence in managing core financial operations within QuickBooks Online, ensuring a solid understanding of its capabilities for effective business management.

- The training emphasizes a practical, action-oriented approach, enabling users to immediately apply learned concepts to their own business finances.

- By the end of this course, participants will have a clear roadmap to harness the power of QuickBooks Online’s state-of-the-art features without feeling overwhelmed.

- Course Structure & Content Focus

- Explores the strategic placement of the Chart of Accounts, emphasizing its role as the backbone of financial reporting and operational efficiency, rather than just a list of accounts.

- Delves into the nuanced art of categorizing diverse business expenditures, highlighting best practices for accurate expense tracking to inform cost-saving strategies.

- Explains the vital link between client invoicing and timely payment collection, focusing on efficient workflow management to improve cash flow.

- Unpacks the process of reconciling bank statements within QuickBooks Online, ensuring the integrity and accuracy of your financial records against external data.

- Introduces strategies for leveraging QuickBooks Online to proactively manage vendor payments and maintain healthy supplier relationships.

- Covers the fundamental principles of sales tax management and how to accurately record and remit it within the QuickBooks Online environment.

- Provides an introduction to managing inventory levels and tracking the cost of goods sold for businesses dealing with physical products.

- Explains how to record and track employee payroll and related tax liabilities within the platform.

- Guides users through the process of setting up and tracking customer and vendor contact information for streamlined communication.

- Offers a glimpse into the advanced features available in QuickBooks Online, encouraging further exploration beyond the beginner stages.

- Target Audience & Learning Philosophy

- Ideal for entrepreneurs, solopreneurs, and small business owners launching or transitioning to QuickBooks Online for the first time.

- Catters to individuals with little to no prior accounting or bookkeeping experience, providing a gentle learning curve.

- Embraces a hands-on learning philosophy, encouraging active participation and application of knowledge.

- Fosters a growth mindset, empowering users to take control of their business finances with confidence.

- Assumes no prior familiarity with accounting software, starting from the absolute basics.

- Requirements / Prerequisites

- Access to a computer or tablet with a stable internet connection.

- A registered QuickBooks Online account (trial or paid subscription).

- Basic computer literacy, including navigating websites and using a mouse and keyboard.

- A desire to understand and manage your business finances effectively.

- No prior accounting degree or formal financial training is necessary.

- Skills Covered / Tools Used

- Proficiency in navigating the QuickBooks Online interface.

- Skills in setting up and customizing company profiles.

- Competence in entering and managing financial transactions.

- Ability to understand and interpret basic financial reports.

- Familiarity with QuickBooks Online’s automated features.

- The core software used is QuickBooks Online.

- The training methodology relies on practical examples and guided walkthroughs.

- Benefits / Outcomes

- Gain the confidence to manage your business finances independently.

- Save time and reduce errors by understanding efficient bookkeeping practices.

- Make more informed business decisions based on accurate financial data.

- Streamline your financial workflows and reduce administrative burden.

- Lay a strong foundation for future financial growth and scalability.

- Reduce reliance on external bookkeepers for day-to-day tasks.

- Achieve greater clarity and control over your business’s financial health.

- Empower yourself with the knowledge to understand your business’s financial narrative.

- PROS

- Concise and Efficient: At 31 minutes, it’s highly time-efficient for busy entrepreneurs.

- Beginner-Focused: Specifically tailored for those new to QuickBooks Online and accounting.

- Practical 10-Step Approach: Offers a clear, actionable framework.

- High Rating: 4.38/5 suggests student satisfaction and effectiveness.

- Updated Content: September 2025 update ensures relevance.

- Removes Overwhelm: Addresses a common pain point for new users.

- CONS

- Due to its brevity, may not cover every nuanced scenario or advanced feature beyond the absolute fundamentals.

Learning Tracks: English,Finance & Accounting,Accounting & Bookkeeping

Found It Free? Share It Fast!