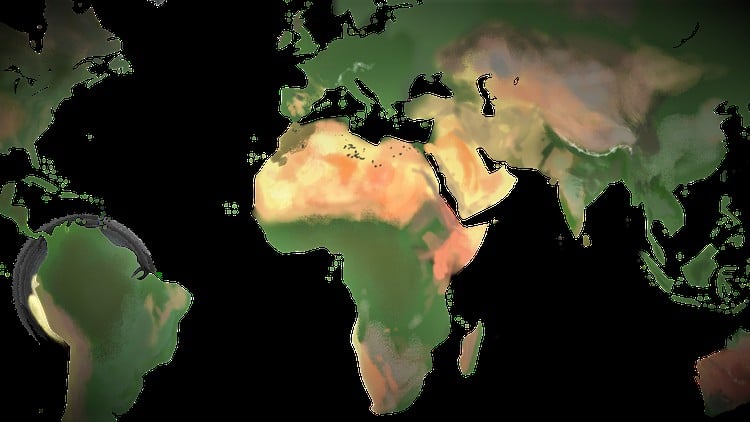

Your essential guide to investing in Africa

⏱️ Length: 1.6 total hours

⭐ 4.48/5 rating

👥 16,286 students

🔄 November 2022 update

Add-On Information:

Note➛ Make sure your 𝐔𝐝𝐞𝐦𝐲 cart has only this course you're going to enroll it now, Remove all other courses from the 𝐔𝐝𝐞𝐦𝐲 cart before Enrolling!

-

Course Overview

- Explore Africa’s dynamic investment landscape, moving beyond generalized perceptions to data-driven realities.

- Uncover the profound demographic shifts driving consumer market expansion and labor force evolution.

- Understand the interplay of regional economic blocs impacting cross-border trade and capital flows.

- Gain insight into the continent’s diverse natural resources and their strategic global importance.

- Examine burgeoning innovation ecosystems and their role in digital transformation across key African hubs.

- Analyze critical infrastructure development in energy, logistics, and digital connectivity, unlocking economic potential.

- Review current geopolitical trends and governance structures influencing investment confidence and regulatory stability.

- Investigate the growing prominence of impact investing, balancing financial returns with sustainable development goals.

- Assess how global macroeconomic shifts and commodity price fluctuations specifically affect African market resilience.

- Develop a foundational understanding of often-misunderstood economic narratives, identifying genuine value propositions.

- Evaluate long-term growth trajectories projected for various African economies based on expert analysis.

- Learn to differentiate short-term market volatility from underlying structural growth for patient capital deployment.

- Appreciate essential cultural nuances and local business practices for sustainable venture success.

- Identify key themes like urbanization, industrialization, and regional integration shaping Africa’s investment story.

-

Requirements / Prerequisites

- An open mind and genuine interest in emerging and frontier market dynamics.

- Basic conceptual familiarity with financial markets and general investment principles.

- No prior direct investment experience in Africa is mandatory; content suits all levels.

- Reliable internet access for seamless course engagement and resource utilization.

-

Skills Covered / Tools Used

- Strategic Market Research: Master data sourcing, evaluation, and synthesis for specific African economies and sectors.

- Risk Mitigation Strategies: Learn to identify, assess, and develop countermeasures for political, economic, and currency risks.

- Due Diligence Framework Application: Apply structured approaches to evaluate opportunities, adapting global best practices.

- Geopolitical & Regulatory Analysis: Interpret complex policies, regulatory shifts, and regional stability factors.

- Network Cultivation Tactics: Understand techniques for building crucial local partnerships and expert connections.

- Sector Opportunity Identification: Pinpoint high-potential sectors and sub-sectors based on macro trends.

- Investment Goal Alignment: Develop clarity on matching investment objectives with viable market and impact opportunities.

- Cultural Intelligence & Adaptability: Enhance capacity to navigate diverse cultural landscapes and local business ethics.

-

Benefits / Outcomes

- Gain a holistic and nuanced understanding of Africa’s true investment potential.

- Identify untapped market segments and high-growth industries for early mover advantage.

- Develop a robust framework for evaluating risks and returns specific to African market complexities.

- Cultivate the ability to strategically source and vet compelling investment opportunities with confidence.

- Empower yourself to make data-driven investment decisions, enhancing potential for success.

- Acquire practical insights into building sustainable and impactful ventures in diverse African contexts.

- Enhance your professional credibility and expertise in one of the world’s most dynamic investment frontiers.

- Be equipped with a clear roadmap for translating theoretical knowledge into actionable investment strategies.

-

PROS

- Provides up-to-date and highly relevant insights into rapidly evolving African markets (November 2022 update).

- Delivers actionable strategies and practical considerations, making complex concepts accessible.

- Taught by experts, offering a balanced perspective on both opportunities and inherent challenges.

- Efficiently structured for busy professionals, offering maximum value in a compact 1.6-hour format.

- Backed by strong student satisfaction, evidenced by its 4.48/5 rating and over 16,000 enrollments.

-

CONS

- As a concise overview, it provides an excellent foundation but requires further deep-dive research and specialized consulting for specific, large-scale investment execution.

Learning Tracks: English,Business,Entrepreneurship

Found It Free? Share It Fast!