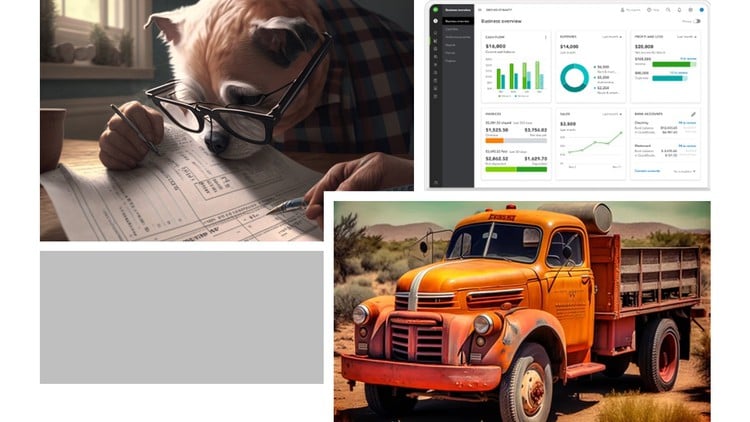

Unlock Efficient Tax Management: Mileage Tracking, Home Office Deductions, and Receipts Management with QuickBooks

⏱️ Length: 6.3 total hours

⭐ 4.69/5 rating

👥 9,083 students

🔄 June 2023 update

Add-On Information:

Note➛ Make sure your 𝐔𝐝𝐞𝐦𝐲 cart has only this course you're going to enroll it now, Remove all other courses from the 𝐔𝐝𝐞𝐦𝐲 cart before Enrolling!

-

Course Overview

- This comprehensive course is meticulously designed for self-employed individuals, small business owners, and freelancers who frequently navigate the complexities of US tax deductions but wish to transform this often-daunting task into a streamlined, efficient, and ultimately profitable process. It demystifies the strategic use of QuickBooks Online to not only track expenditures but to proactively manage your financial records with an eye toward maximizing legitimate tax savings.

- Move beyond merely collecting receipts; this course introduces a paradigm shift in how you perceive and manage your operational expenses, positioning QuickBooks Online as your indispensable financial co-pilot. You will learn to integrate a disciplined approach to expense management directly into your daily workflow, ensuring no potential deduction is overlooked or mishandled.

- Dive into the practical application of digital tools to capture and categorize every relevant financial transaction, fostering an environment of continuous financial clarity. The curriculum emphasizes building an audit-proof trail for your deductions, instilling confidence and significantly reducing year-end tax season stress.

- Explore the nuanced strategies for identifying and substantiating often-missed deductions, thereby optimizing your taxable income throughout the year, rather than just reacting to it during tax preparation. This course is about empowering you with the knowledge and tools to take full control of your business’s financial health.

- Understand the symbiotic relationship between diligent record-keeping in QuickBooks Online and effective tax planning. This is not just about compliance; it’s about leveraging your financial data as a strategic asset to foster business growth and improve your bottom line.

-

Requirements / Prerequisites

- Active QuickBooks Online Subscription: Participants should have access to a QuickBooks Online account (any plan will generally suffice, though a Self-Employed or Essentials+ plan is ideal for full feature access).

- Basic Computer Literacy: Familiarity with navigating web browsers, using online applications, and basic file management (uploading/downloading files).

- Fundamental Understanding of Your Business Operations: A general awareness of your own business activities and the types of expenses you incur will be beneficial.

- Willingness to Engage: An eagerness to learn and apply new digital financial management techniques is key to maximizing your learning experience.

- No Prior Accounting Expertise Required: The course is structured to be accessible to those without formal accounting training, focusing on practical application within QuickBooks Online.

- Stable Internet Connection: Essential for seamless access to QuickBooks Online and course materials.

-

Skills Covered / Tools Used

- Digital Record-Keeping Mastery: Develop advanced techniques for digitizing and archiving financial documents directly within QuickBooks Online, moving towards a paperless system.

- Proactive Expense Categorization: Cultivate the skill of correctly classifying business expenses as they occur, ensuring accurate financial reporting and maximizing deductibility.

- Strategic Use of QBO Mobile App: Learn to leverage the QuickBooks Online mobile application for on-the-go receipt capture and mileage tracking, transforming your smartphone into a powerful tax deduction tool.

- Custom Report Generation: Gain proficiency in generating tailored reports within QuickBooks Online that provide clear, concise summaries of deductible expenses for tax preparation purposes.

- Workflow Automation: Implement efficient digital workflows within QuickBooks Online to streamline the process of recording, reviewing, and reconciling tax-relevant transactions.

- Audit-Readiness Protocol Development: Establish best practices for maintaining comprehensive and easily accessible records, preparing you confidently for potential IRS inquiries.

- QuickBooks Online Interface Navigation: Become adept at navigating specific sections of QuickBooks Online relevant to expense management, including transactions, banking, and reports.

- Data Import and Export Principles: Understand how to effectively manage financial data flow into and out of QuickBooks Online for various analytical or reporting needs.

-

Benefits / Outcomes

- Significant Tax Savings: Confidently identify and claim all legitimate deductions, leading to a noticeable reduction in your annual tax liability and improving your business’s profitability.

- Enhanced Financial Control: Gain a deeper understanding and proactive command over your business’s financial data, enabling smarter budgeting and strategic financial decisions.

- Stress-Free Tax Season: Eliminate the frantic scramble for receipts and documentation as tax deadlines approach, replacing it with an organized, calm, and efficient process.

- Audit Confidence: Develop an organized, digital system of record-keeping that provides clear, defensible evidence for all your deductions, giving you peace of mind.

- Time Efficiency: Reclaim countless hours previously spent on manual data entry, paper filing, and reconciliation, allowing you to focus more on core business activities or personal pursuits.

- Improved Financial Visibility: Access real-time insights into your business expenses, helping you identify spending patterns, areas for cost reduction, and opportunities for growth.

- Professional Record-Keeping Standards: Adopt industry-best practices for maintaining financial records, bolstering your business’s credibility and operational efficiency.

- Empowered Financial Literacy: Cultivate a stronger understanding of how your daily business activities directly impact your tax obligations, transforming you into a more informed financial manager.

-

PROS

- Actionable and Practical: Focuses on immediate, real-world application of QuickBooks Online features to solve common tax deduction challenges.

- Up-to-Date Content: Reflects current best practices and features within QuickBooks Online, ensuring relevant and timely instruction with its June 2023 update.

- Highly Rated by Peers: A strong 4.69/5 rating from over 9,000 students signifies high satisfaction and effective teaching.

- Targeted Problem Solving: Directly addresses major pain points for self-employed individuals concerning mileage, home office, and receipt management.

- Efficiency-Oriented: Teaches methods to save significant time and effort in financial tracking and tax preparation.

- Comprehensive Coverage: While focused, it covers the entire lifecycle of deduction management from tracking to reporting.

- Builds Confidence: Equips learners with the tools and knowledge to manage their tax deductions independently and with assurance.

-

CONS

- Requires QBO Subscription: The practical application of the course material is dependent on having an active QuickBooks Online subscription, which is an additional ongoing cost.

Learning Tracks: English,Finance & Accounting,Taxes

Found It Free? Share It Fast!